The Federal Reserve sets short-term interest rates through the federal funds rate. These decisions ripple across the economy, impacting everything from your savings account to the cost of borrowing money for businesses. But—and here’s the twist—mortgage rates don’t follow the Fed like a puppy chasing treats. Instead, they trail behind the 10-year Treasury yield like a shadow at sunset.

Why? Because most U.S. mortgages, particularly the 30-year fixed rate kind, are influenced more directly by the movement of the 10-year Treasury yield. Lenders look to this benchmark as a low-risk baseline and then add a little extra (a “spread”) to account for borrower risk and profit margin.

So when the yield on the 10-year Treasury rises, mortgage rates tend to follow. And when it falls—yes, rates usually drop too. It’s that bond-market magic doing its thing.

Why Mortgage Rates Are So Jumpy Right Now

Lately, we’ve seen a tug-of-war between inflation fears and hopes for rate cuts. This makes the bond market twitchy—and when bond prices fall, yields go up. That, in turn, sends mortgage rates on an upward march. On the flip side, any sign that inflation is cooling or the economy is slowing can send Treasury yields tumbling, dragging mortgage rates down with them.

And while the Fed still holds considerable influence (especially when making announcements or releasing economic projections), market participants often pre-empt the Fed’s moves based on what’s happening with jobs data, inflation reports, and geopolitical events. In essence, mortgage rates are front-running the Fed based on the 10-year note’s vibe.

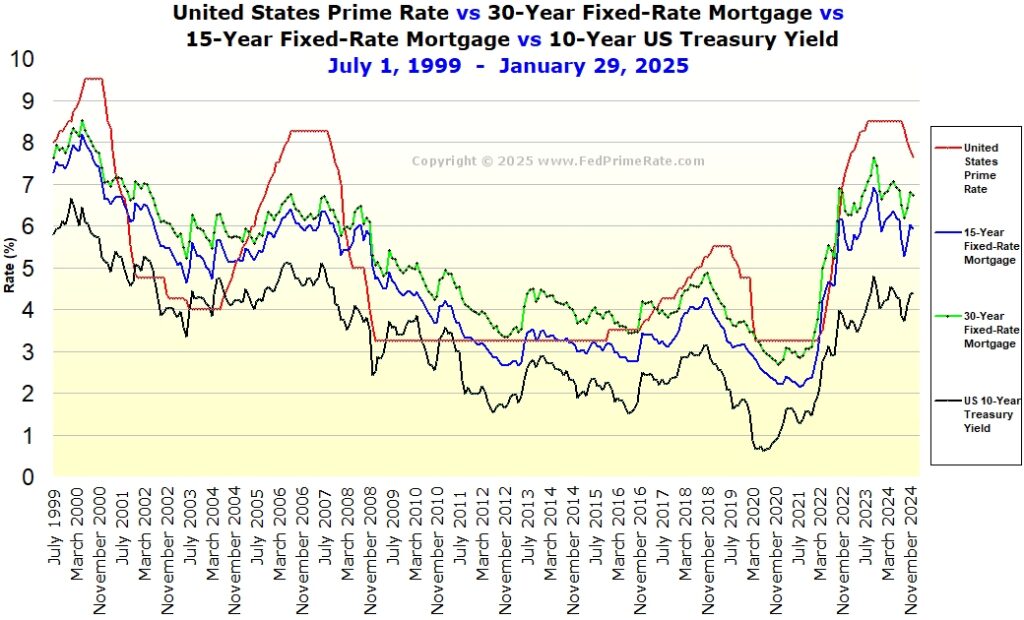

Visualizing the Connection

To better understand this relationship, consider the following chart that illustrates the correlation between the 10-year Treasury yield and the 30-year fixed mortgage rate over time:

Source: Federal Reserve Bank of St. Louis

As depicted, the 30-year fixed mortgage rate closely follows the movements of the 10-year Treasury yield, highlighting the bond market’s significant influence on mortgage rates.

What This Means for You

If you’re a homeowner considering a refinance or a buyer waiting for the “perfect” rate, here’s your game plan:

- Watch the 10-Year Treasury Yield – It’s a leading indicator for mortgage rates. Financial news sites often feature this number on the homepage.

- Don’t Time the Market – Rates will remain volatile in the near term. If you see a rate that works for your budget, consider locking it in.

- Use an Appraiser Strategically – If you’re refinancing, a proper appraisal could help you drop PMI or tap into increased home equity. Appraisers can also help project value trends with prospective or after-renovation valuations, especially useful if rates remain sticky.

Bottom Line

The 10-year Treasury note is the real MVP when it comes to mortgage rate movement. While the Fed is still important, it’s the daily dance of bond yields that often determines how much you’ll pay for your next mortgage. So the next time you hear someone blame the Fed for a jump in rates, you might gently nudge them toward the bond market for the full story.

Want to stay in the loop with expert insights on valuations, market trends, and mortgage moves? Subscribe to The Redefine Value Post and drop a comment below—we’d love to hear your thoughts!